Cryptocurrency Lending

Cryptocurrency lending refers to the process of loaning fiat money or a stable digital asset for a fixed period of time and an interest rate. This is the first in a series of alerts about risk mitigation in the digital assets sector.

Cryptocurrency lending firm BlockFi raises 18.3M from

Cryptocurrency lending firm BlockFi raises 18.3M from

Whether a user has bitcoin,.

Cryptocurrency lending. Once, the borrower repays the loan with interest. Firm believer and advocate for digital, decentralized, and integrated direct lending platforms. Safe, secure, and innovative institutional and p2p cryptocurrency lending solutions for the next generation of financial pioneers.

Today, let’s deep dive into crypto lending, which has gained popularity over the past few months by being a very popular defi example. The lender can lend the amount to borrower and earn interest over it. Lenders earn 4.8% apr on their deposited btc, which is above average.

Young cryptocurrency lending platform without a proven track record. The places where one is able to loan or borrow are called crypto lending platforms. Here’s what you need to know.

However, the few that gained traction in the market have since been key in. With this new trend around defi, many new ways to grow your crypto assets are emerging. The startup was founded back in 2017, for the purpose of harnessing the potential of blockchain technology in order to offer consumers economic opportunities, financial freedom, and income equality.

The lending process typically involves two or three parties: In return, they receive interest payments. Because these platforms deal in cryptocurrency, the interest payments are almost always paid in crypto.

Helio lending is the first licensed and regulated cryptocurrency lender based in australia. A borrower, a lender, and a platform that connects both sides of the transaction. One can lend assets like bitcoin, ethereum, ripple, litecoin, etc easily to earn extra money through interest.

The minimum loan amount is 1,000 xrp (around. According to an announcement from the group's crypto exchange, sbi vc trade, xrp lending is available from today with a lending period from 84 days.; Cryptocurrency lending is perhaps one of the most interesting fields to discuss as these services saw a serious spike in interest and profitability despite 2018’s prolonged bear market.

The transaction is supported by crypto lending platforms selling loans to various cryptocurrencies such as ether, bitcoin, and stable coins. The general idea is that lenders are able to use these platforms to earn interest on their idle crypto assets, and borrowers are able to take out a loan. Cryptocurrency lending platforms operate essentially as brokers between lenders, and borrowers.

This website contains depictions that are a summary of the process for obtaining a loan and provided for illustrative purposes only. Most loans are approved on the same day as application, with terms clearly laid out for users. Helio lending prides itself on speed;

Lending rates rise when there is more demand than supply and fall when there is more supply than demand. What is crypto lending & lending platforms? Lending cryptocurrency so as to earn interest in your ideal lying cryptocurrencies is called crypto lending.

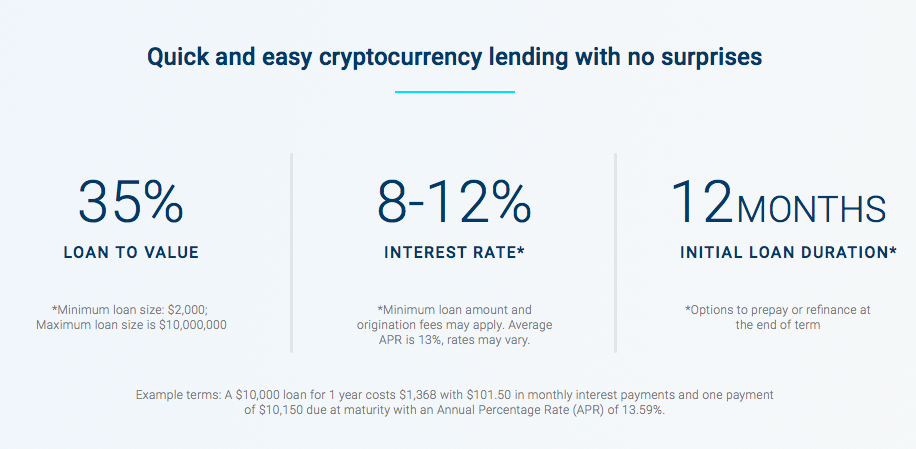

For example a one year $10,000 loan with a rate of 6.00% apr would have 12 scheduled monthly payments of $861. Cryptocurrency and blockchain technology is not just the future of finance, it is the pathway to financial security. Cryptocurrency lending platform works by connecting borrowers to a network of lenders registered on the platform.

To borrow an amount, the borrower needs to first deposit his/her crypto assets on the platform as collateral. Coincheck lending is cryptocurrency lending service where a user can lend cryptocurrency for a certain period to coincheck by agreeing on the loan contract agreement. Risks and pitfalls of cryptocurrency lending.

With this said, let’s have a look at the three of the best cryptocurrency platforms today. As bitcoin moves into the mainstream financial world, the demand for reputable cryptocurrency lending programs is on the rise as they are a great way for investors to earn dividends and get crypto loans. Some of the risks to be aware of when using cryptocurrency lending platforms, as either a lender or a borrower, include:

Get a cash or crypto loan with cryptocurrency as collateral. Crypto lending allows you to put your cryptocurrency up as collateral for a fiat loan. You can also do this with a much lower interest than you’d get from a bank.

22 best crypto lending programs rated & reviewed list. Lenders can first experiment with demo funds to find the best crypto lending option for themselves. The celsius network is without a doubt, one of the most popular cryptocurrency lending choices available on the market right now.

Most interest rates are marked as annual returns, and are often subject to change when the wide cryptocurrency market is suffering from rapid volatility in the underlying price(s) of the assets being supplied. Crypto lending is a transaction in which you can lend your crypto and earn interest rates that accrue over a period of time. In other words, you could increase your earnings by making your crypto available to firms and individuals looking to borrow crypto and pay back with interests.

The platform provides cryptocurrency holders a secure way to access fiat funds without selling any of their cryptocurrency. Upon expiration or termination of the agreement, coincheck will return cryptocurrency with annual % rate on top of it.

P2P Cryptocurrency Lending Platforms Explained • Newbium

P2P Cryptocurrency Lending Platforms Explained • Newbium

Best Cryptocurrency Lending Platforms Guide to Crypto

Best Cryptocurrency Lending Platforms Guide to Crypto

CRYPTOCURRENCY BACKED BY REAL ESTATE 100 A Peertopeer

CRYPTOCURRENCY BACKED BY REAL ESTATE 100 A Peertopeer

P2P Bitcoin Lending Script CryptoCurrency Clone

P2P Bitcoin Lending Script CryptoCurrency Clone

Top 3 Cryptocurrency Lending Platforms

Top 3 Cryptocurrency Lending Platforms

Explaing the fundamentals of blockchain technology.

Explaing the fundamentals of blockchain technology.

Cryptolending is on the rise with Celsius Network

Cryptolending is on the rise with Celsius Network

Top 15 Cryptocurrency Lending Platform Crypto Lending

Top 15 Cryptocurrency Lending Platform Crypto Lending

Top 3 Cryptocurrency Lending/Exchange Platforms Review

Top 3 Cryptocurrency Lending/Exchange Platforms Review

Cryptocurrency lending company BlockFi allows users to buy

Cryptocurrency lending company BlockFi allows users to buy

P2P Cryptocurrency Lending Grows Increasingly Popular in

P2P Cryptocurrency Lending Grows Increasingly Popular in

Major cryptocurrency lending protocols processed more than

Major cryptocurrency lending protocols processed more than

Cryptocurrency Lending Firm Nexo Adding Support For

Cryptocurrency Lending Firm Nexo Adding Support For

Introduction to Cryptocurrency Lending SelfKey

Introduction to Cryptocurrency Lending SelfKey

Lavenir, the Cryptocurrency Lending Platform Will Launch

Lavenir, the Cryptocurrency Lending Platform Will Launch

Top 15 Cryptocurrency Lending Platform Crypto Lending

Top 15 Cryptocurrency Lending Platform Crypto Lending

Margin Lending Earn the best interest rates in the

Introduction to Cryptocurrency Lending SelfKey

Introduction to Cryptocurrency Lending SelfKey

5 Best Crypto Backed Loan Platforms Coingyan

5 Best Crypto Backed Loan Platforms Coingyan

Comments

Post a Comment