Audit Cryptocurrency

Our ability to audit an entity engaged in cryptocurrency activities is very much influenced by our client’s control environment, and at this stage, by the breadth of tokens supported by our halo software. The irs will request records to support the information on your tax returns.

The IRS Has Cryptocurrency on Its Radar IRS Problem Solvers

The IRS Has Cryptocurrency on Its Radar IRS Problem Solvers

Companies obliged to audit their annual financial statements must find an auditor who has the ability to audit cryptocurrency.

Audit cryptocurrency. Feb 10, 2021 it is becoming common for financial statements to show material cryptocurrency balances and to reflect the results of cryptocurrency transactions. This new and unique industry has catalysed the need for a traditional audit, tax and advisory service providers to also adapt in order to serve clients who operate in the cryptocurrency space. Most of them have already ceased to exist and are no longer listed on any exchange platforms, but there are still a handful of projects that are operating and growing.

These considerations will be key when determining whether we are comfortable to accept an audit engagement. Contact silver tax group to speak to a tax expert about avoiding a cryptocurrency audit today. Tax laws involving the taxation of cryptocurrency can be very complicated.

A cryptocurrency security standard auditor is an expert in the ccss. 10 questions every board should ask about cryptocurrencies. There have been a number of developments with respect to the taxation of cryptocurrency in canada.

With more than 2,500 cryptocurrencies, each with its own characteristics and special features and a highly volatile market with numerous challenges, auditors must call on cryptocurrency technology experts. Audit clients should be aware that an inadequate internal control system in this context might result in higher audit fees due to additional audit procedures and increased risk or even a disclaimer of opinion. The irs tax laws involving cryptocurrency continue to evolve.

The irs is hiring cryptocurrency experts to assist in virtual currency audits, a clear signal those audits will be on the rise. It can be a complicated process, but with the right tax attorney, you won’t have to worry about a thing. Complete cryptocurrency audits list research.

Contact our cryptocurrency audit solutions team. This is a demo exam that illustrates how the final exam will work. In the case of a cryptocurrency audit, you will also need a detailed report of your trading history for the years in question.

Within the audit an entity will have to demonstrate existence of its cryptocurrency holdings. Tax laws involving the taxation of cryptocurrency can be very complicated. Auditing cryptocurrency requires a different set of knowledge, methods and approaches than conventional currency.

Within mazars, we have built sector specialism and expertise to provide businesses in the crypto sector with audit, tax, accounting and advisory services. The tax laws surrounding crypto are under constant revision, meaning it can be difficult to know the implications of. From an it audit perspective, testing for ccss compliance will provide a reasonable degree of assurance that the risks related to the management crypto.

Below is a list of cryptocurrency accounting firms—including the big four and beyond. Guidance to help boards engage in constructive dialogue about the potential strategic fit of cryptocurrencies. This is primarily due to the fact that the internal revenue service treats cryptocurrency as property, even though it is generally thought of as currency.

This can include paychecks, bank statements, and receipts for any expenses you claimed. Ey, pwc, deloitte, and kpmg) firms have disclosed during 2018 that they are currently looking into developing audit technology for cryptocurrencies and blockchains. There are over 1,000 cryptocurrencies and each one has its own characteristics and particularities.

Close start adding items to your reading lists: There are over 1,000 cryptocurrencies and each one has its own characteristics and particularities. On march 8, 2019, the cra released updated compliance guides on cryptocurrency.

Cryptocurrency virtual currency cryptocurrency audit. While further cryptocurrency regulation is certainly on its way, and with the international common reporting standards now in full swing, lobban said that audit requests are still a primary weapon. Over the entire existence of cryptocurrencies, several thousand different projects have been launched.

The last thing you want is a cryptocurrency audit if you fail to properly report. The irs tax laws involving cryptocurrency continue to evolve. So much so, that the big four (the world’s most important accounting firms:

Companies obliged to audit their annual financial statements must find an auditor who has the ability to audit cryptocurrency. Audit considerations related to cryptocurrency assets and transactions published on: Donnelly’s service has so far seen two cryptocurrency audits with its clients, and the tax professional is interested in learning more about what triggers an irs investigation.

Auditing cryptocurrency requires a different set of knowledge, methods and approaches than conventional currency. The cra has recently updated its compliance guidelines and appears to be engaged in increased bitcoin audit activity. (for deloitte’s perspectives on blockchain technology, including a discussion of cryptocurrency, see blockchain technology and its potential impact on the audit and assurance profession.)

The cra takes the view that payments. Instead of possessing a physical form, cryptocurrency exists as immutable distributed ledgers maintained on public blockchains. Most of us despise tax season, but the added complication of having to file cryptocurrency returns in 2021 can make it even messier.

Ccssas are able to apply the ccss standard to any information system that uses cryptocurrencies, calculating a grade for the system according to the ccss. 2 audit considerations related to cryptocurrency assets and transactions • examples of matters to consider in identifying and assessing risks of material misstatement in cryptocurrency transactions and balances nine examples are provided of conditions or events that may result in a material misstatement. Here’s how the cryptocurrency audit process works:

We identify cryptocurrency issues and risks that auditors need to consider during client acceptance and retention as well as a cryptocurrency framework for audit planning and gathering audit evidence to support management assertions regarding their financial statements.subsequent discussion of issues related to cryptocurrency is limited to cryptocurrency assets used as a medium of exchange in.

IRS Cracking Down on Cryptocurrency Tax Evasion, Seeks

IRS Cracking Down on Cryptocurrency Tax Evasion, Seeks

The IRS Confirms a new Wave of Cryptocurrency Audits is

The IRS Confirms a new Wave of Cryptocurrency Audits is

Audit considerations related to cryptocurrency assets and

Audit considerations related to cryptocurrency assets and

CRA Audits Cryptocurrency Revised Canadian Tax Amnesty

CRA Audits Cryptocurrency Revised Canadian Tax Amnesty

IRScryptocurrencytimelinecliffordphotography

IRScryptocurrencytimelinecliffordphotography

Got Cryptocurrency? Get Ready For An IRS Audit

Got Cryptocurrency? Get Ready For An IRS Audit

Advancement in Accounting and Audit through BlockChain

Advancement in Accounting and Audit through BlockChain

Discover the audit process of cryptocurrency exchange

Discover the audit process of cryptocurrency exchange

Bulgarian Revenue Agency to audit cryptocurrency companies

Bulgarian Revenue Agency to audit cryptocurrency companies

What business leaders need to know about cryptocurrency

What business leaders need to know about cryptocurrency

IRS Solicits Contractors to Audit Cryptocurrency Tax Returns

IRS Solicits Contractors to Audit Cryptocurrency Tax Returns

TokenInsight Utilizes AnChain.AIs Contract Auditing

TokenInsight Utilizes AnChain.AIs Contract Auditing

Building trust in the cryptocurrency world with audit

Building trust in the cryptocurrency world with audit

New version of crypto asset trading platform dYdX launches

New version of crypto asset trading platform dYdX launches

Cryptocurrency audits tipped to increase this EOFY

Cryptocurrency audits tipped to increase this EOFY

Cryptocurrency exchange full audit Portfolio Inn4Science

Cryptocurrency exchange full audit Portfolio Inn4Science

Cryptocurrency exchange full audit Portfolio Inn4Science

Cryptocurrency exchange full audit Portfolio Inn4Science

CRA Audits Cryptocurrency Revised Canadian Tax Amnesty

CRA Audits Cryptocurrency Revised Canadian Tax Amnesty

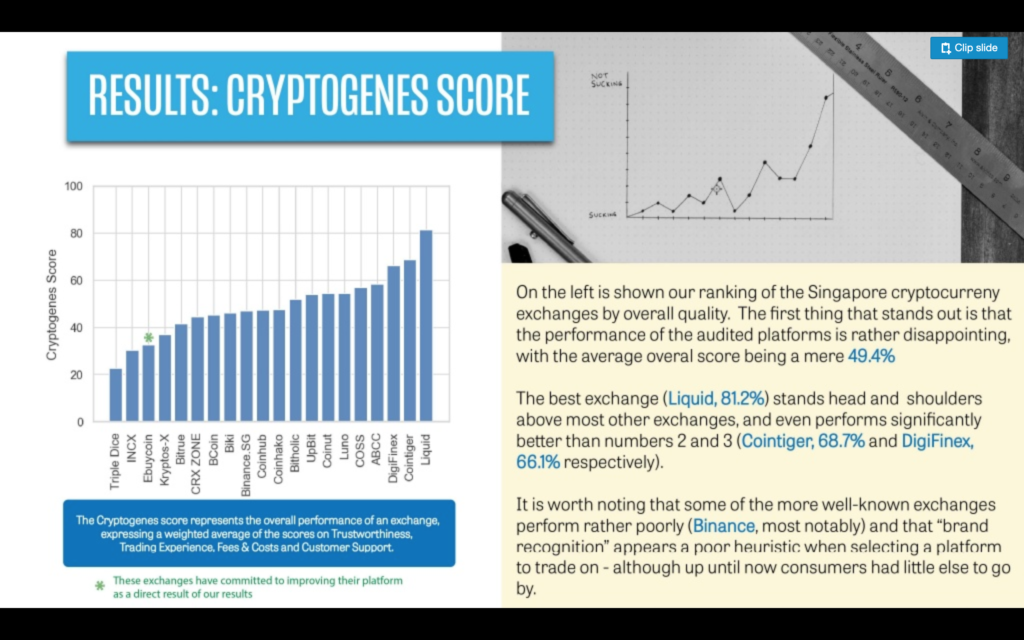

Swiss Research Firm Lists Singapore’s Best and Worst

Swiss Research Firm Lists Singapore’s Best and Worst

Comments

Post a Comment